Art auctions have recently seen some eye-popping numbers. For instance, Leonardo da Vinci’s “Salvator Mundi” sold for a staggering $450 million. This raises an intriguing question: are we witnessing a sound investment trend or the inflating of a dangerous bubble? In this article, we’ll dive into the factors driving these prices and explore whether this surge is sustainable or speculative.

Historical Context

Art has long been viewed as a valuable investment. Historically, paintings by artists like Van Gogh and Picasso have appreciated significantly. Art has also served as a status symbol, reflecting wealth and taste. However, the art market has seen its share of bubbles, such as the dramatic crash in the Japanese art market in the 1990s.

The value of art has always been subject to fluctuations. The Renaissance period, for example, saw artists’ works appreciated only after their deaths. In the modern era, speculative bubbles have formed, notably the tulip mania, which also included high-priced floral artworks. These historical instances offer a cautionary tale for today’s soaring art prices.

Art as an investment is not a new concept. Wealthy patrons and collectors have long sought after prized pieces. The 20th century saw the rise of modern and contemporary art as key investment categories. This shift has set the stage for the current art market boom.

The Current State of the Art Market

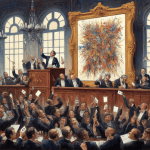

The art market today is characterized by record-breaking sales. Auction houses like Sotheby’s and Christie’s are at the forefront, setting new benchmarks. Recent sales have seen contemporary art pieces fetch astronomical sums. This trend suggests a robust market, but it also hints at possible overvaluation.

Market trends reveal a significant rise in contemporary art values. Artists like Jeff Koons and Banksy dominate headlines with their high-priced sales. The demand for contemporary pieces reflects changing tastes and investment strategies. This sector’s growth, however, raises questions about sustainability.

The role of auction houses cannot be overstated. They wield significant influence over art prices and trends. By curating high-profile auctions, they attract wealthy collectors and investors. This dynamic creates a self-perpetuating cycle of rising prices.

Moreover, art fairs and exhibitions contribute to the market’s vibrancy. These events bring together collectors, artists, and galleries. They offer a platform for new talents and established names alike. Such gatherings fuel the market’s momentum and price hikes.

Factors Driving High Prices

Wealth inequality plays a pivotal role in driving high art prices. Ultra-rich collectors view art as a means of diversification and status. Their purchasing power inflates prices, creating a market accessible only to the elite. This phenomenon raises concerns about market stability and accessibility.

Globalization has expanded the art market’s reach. Emerging markets like China and the Middle East have become significant players. Their demand for high-end art boosts prices worldwide. This global interest underscores art’s universal appeal but also its vulnerability to economic shifts.

Speculative investments are increasingly common in the art world. Investors treat art like stocks, seeking short-term gains. This approach drives prices up but adds volatility to the market. The involvement of art funds and art-backed loans further complicates the investment landscape.

The rise of art funds reflects a shift towards financialization. These funds pool resources to invest in high-value art. They aim for capital appreciation, similar to traditional investment vehicles. However, this trend also contributes to market speculation and instability.

Investment vs. Bubble Debate

Proponents argue that art is a sound investment. Historical appreciation rates support this view. Art offers a tangible asset, often appreciating during economic uncertainty. Moreover, its emotional and cultural value adds to its investment appeal.

Critics, however, see the current market as a bubble. Volatility and unpredictable trends fuel their concerns. The market’s reliance on wealthy buyers and economic stability is a risk. Comparisons to other asset bubbles, like real estate and tech stocks, add weight to this argument.

Art’s unique nature complicates the investment versus bubble debate. Unlike traditional assets, its value is subjective. Market trends can shift due to changing tastes and cultural factors. This unpredictability adds both risk and allure to art investments.

The debate also highlights differing investor motivations. Some view art purely as a financial asset. Others see it as a passion investment, valuing its aesthetic and cultural significance. This duality underpins the ongoing discussion about art’s place in investment portfolios.

Risks and Rewards

Investing in art carries notable risks. The market lacks liquidity, making it hard to sell quickly. Transaction costs, including auction fees and taxes, are high. Additionally, the risk of forgery and provenance issues can undermine investments.

Despite the risks, the potential rewards are significant. Art can yield high returns, especially for rare and sought-after pieces. It also offers diversification benefits, reducing portfolio risk. Moreover, art investments can provide tax advantages and philanthropic opportunities.

Market saturation and changing tastes pose additional risks. Popular artists today may fall out of favor tomorrow. This unpredictability requires investors to stay informed and adaptable. Navigating these challenges is crucial for long-term success in art investment.

Investing in art also involves non-financial rewards. Collectors gain personal satisfaction and cultural enrichment. Owning a piece of history or supporting contemporary artists adds value beyond money. These intangible benefits often drive collectors as much as financial gain.

Expert Opinions and Case Studies

Art market experts offer diverse perspectives. Some view the current trend as sustainable, citing historical growth. Others warn of an impending correction, highlighting market volatility. Quotes from gallery owners, auctioneers, and financial analysts provide insight into this complex market.

Case studies illustrate the highs and lows of art investments. Successful investments, like those in blue-chip artists, show potential for high returns. However, failed investments, often in lesser-known artists, highlight market risks. These examples underscore the need for careful research and strategy.

Experts emphasize the importance of understanding the art market. Knowledge of art history, trends, and market dynamics is crucial. This understanding helps investors make informed decisions and avoid pitfalls. Professional advice and continuous education are vital tools for success.

Diverse expert opinions reflect the market’s complexity. No single perspective can fully capture its nuances. Investors must weigh various factors and stay informed. This approach helps navigate the art market’s opportunities and risks effectively.

Practical Advice for Aspiring Art Investors

Research and education are essential for art investors. Understanding art history and market trends provides a solid foundation. Numerous resources, including books, courses, and online platforms, offer valuable insights. Continuous learning helps investors stay ahead of market changes.

Building a collection requires strategic planning. Starting small and gradually expanding is a prudent approach. Authenticity, condition, and provenance are key considerations. These factors influence both the value and enjoyment of an art collection.

Working with professionals can enhance investment outcomes. Art advisors and appraisers provide expert guidance. They help navigate the market’s complexities and identify quality pieces. Legal and financial considerations, including contracts and insurance, are also crucial.

Engaging with the art community enriches the investment experience. Attending galleries, auctions, and fairs offers exposure to diverse artworks. Networking with other collectors and professionals provides valuable connections. This involvement deepens appreciation and understanding of the art world.

Conclusion

The skyrocketing prices in the art market spark both excitement and caution. Historical trends and current dynamics offer insights into this complex market. Whether viewed as a sound investment or a bubble, art remains a captivating asset. Its unique blend of financial and cultural value continues to intrigue and challenge investors.

As we’ve explored, the art market is shaped by a myriad of factors. Wealth inequality, globalization, and speculative investments drive prices. While risks are inherent, the potential rewards make art an appealing investment. The debate between investment and bubble persists, reflecting the market’s multifaceted nature.

Ultimately, art investment is both a financial and personal journey. It requires careful research, strategic planning, and a passion for the arts. By navigating this intricate landscape, investors can find both profit and pleasure. So, is art worth the risk, or are we teetering on the edge of a bubble? The answer may lie in your next auction paddle.

Happy collecting! Whether you’re a seasoned investor or a curious newcomer, exploring the art world can be a rewarding adventure. Keep learning, stay curious, and don’t forget to visit your local galleries. Art is as much about enjoyment as it is about investment.